Avail Business Loan up to Rs.15 Lakhs in 15 Mins!

Quick Loan Disbursement Easy EMI: Only 1982/- Interest Rate 12.5% p.a.

Start Your Loan Process With Basic Detail:

NBFC Personal Loan Criteria for Small Business

NBFC Personal Loan Criteria for Audited Report

How it works?

Enter Basic Details

Check Eligibility

Get Membership

Submit Documents

Bank Verification

Bank Sanction

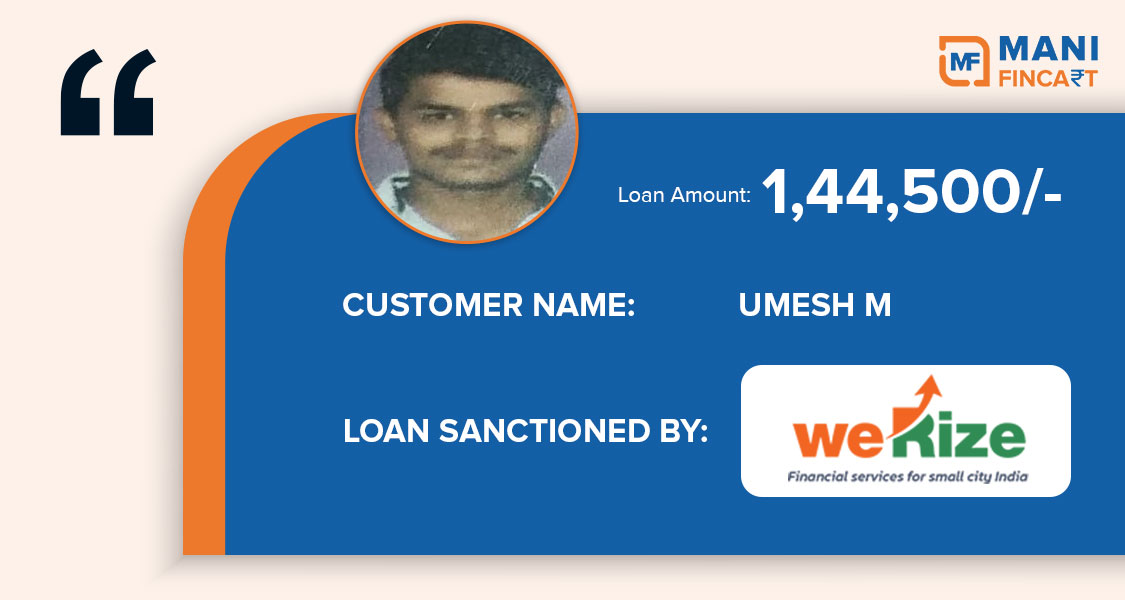

Attaining Customer Praises Is Our Routine!

Loan Processing fee will be charged upto 2%, loan tenure ranging from a minimum of 6 months to a maximum of 72 months with Annual 11% minimum interest Rates and maximum of 34%. For Example: Considering a personal loan of Rs.1,00,000 availed at 12.5%* interest rate for a tenure of 6* years with 2%* processing fee, the APR will be 13.27%*. *T&C Apply. All these numbers are tentative/indicative, the final loan specifics may vary depending upon the customer profile and NBFCs’ criteria, rules & regulations, and terms & conditions.

Company Registered Address : 2nd Floor, 202/b, Shivalik Plaza, Near Kapodra Utran Bridge, Mota Varachha, Surat Gujarat, India - 394101